Trump’s Big Beautiful Bill: Nevada’s Wins and Losses

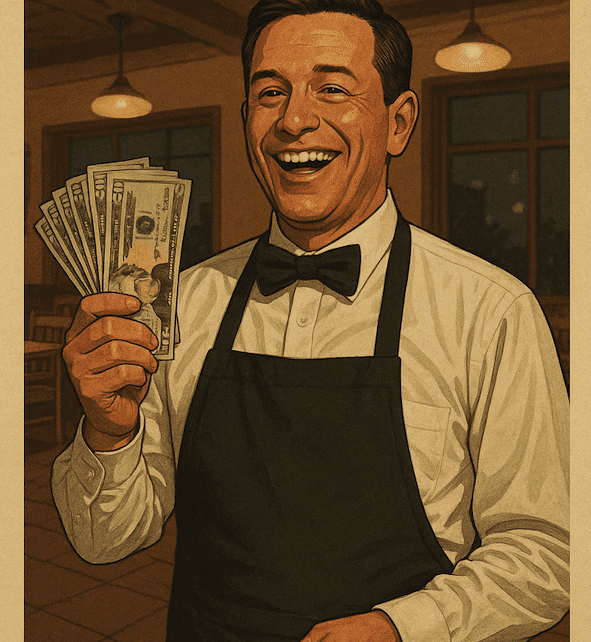

Part 1: Your Tips Are Tax-Free, Nevada Servers Rejoice!

By TheNevadaGlobeStaff, July 9, 2025 3:00 am

This isn’t a free lunch. Payroll taxes for Social Security and Medicare still apply, so Carlos keeps $1,200 after deductions. Compare this to pre-2017 tax codes, when tips were fully taxed, and it’s clear this helps. Critics call it a temporary sop, but for servers grinding 12-hour shifts on the Strip, it’s real money. In 2024, Nevada’s hospitality sector added 15,000 jobs, and this break could fuel more spending at local shops.

Nevada’s workers are the state’s heartbeat, powering casinos and diners alike. As you pocket this extra cash, consider what it means for a state built on service. Could this spark a broader push for worker-friendly policies, or is it a fleeting win in a tough economy?

————————————————————————————

Speak Up, Nevada! What’s on Your Mind? Send us your opinion!

Got the inside scoop on something happening in Nevada? Or the country? Do you have thoughts about life in Nevada that are too good to keep to yourself? Whether it’s a hot take on our politics, crime, education, or even the secret to surviving our summers, we’re all ears! Swing them our way at editor@thenevadaglobe.com. Come on, give us the scoop on what makes Nevada tick—or what ticks you off. Let’s make some noise and have some fun with it!

- America Is Winning Again as President Trump Ushers in a New Golden Age - January 22, 2026

- Party First, Nevada Last: Titus, Lee, Horsford Back Jeffries’ Push to Defund DHS - January 22, 2026

- Student Walkouts Held at Las Vegas Schools Over ICE Concerns - January 21, 2026