Film Tax Credit Expansion Fails in Nevada Legislative Session

By TheNevadaGlobeStaff, November 20, 2025 2:45 pm

Efforts to significantly expand Nevada’s film tax credit system concluded on Wednesday evening as the State Senate did not pass the proposed bill. The legislation, which had been the focus of a multiyear push by major film studios, did not secure the necessary majority, with 10 of 21 senators voting in favor. Three senators were absent during the vote. Sources involved in the discussions indicated that an additional vote is not anticipated before the special legislative session concludes.

The proposed bill would have committed Nevada to providing $120 million annually in transferable tax credits to film production companies for a period of 15 years, starting in 2029. Supporters argued the measure would generate construction employment and increase funding for Clark County’s pre-kindergarten programs. However, both proponents and opponents acknowledged the initiative would not yield a positive financial return for the state, with legislative analysts projecting potential state budget deficits once the credits were implemented.

The bill’s failure, which was a central purpose of the special session, represents a setback for Republican Governor Joe Lombardo, who was expected to sign it. It also marks a loss for other advocates, including construction trade unions and Assemblywoman Sandra Jauregui (D-Las Vegas), who sponsored the bill and is a candidate for lieutenant governor. Following the vote, Assemblywoman Jauregui commented, “I did everything I could to make my case, and it just didn’t have the votes. You lose with grace.”

The outcome is a notable victory for an unconventional coalition of progressive and conservative groups that opposed the bill. An earlier attempt to defeat the bill in the Assembly through a procedural motion was unsuccessful, and the bill narrowly passed the Assembly with a 22-20 vote. However, it required Senate approval to advance to the Governor’s desk. The bill’s rejection may carry implications for the upcoming year’s political landscape.

Governor Lombardo issued a statement saying, “I appreciate thoughtful policy discussions about how to bring new, good-paying jobs to Nevada and further diversify our economy.” He added, “Since taking office, my administration has been focused on expanding opportunity and attracting new industries to our state, so that future generations of Nevadans can build their lives and careers right here at home. Nevada is open for business, and my administration will continue to fight for Nevada to be a competitive, innovative, and prosperous place for all who call it home.”

Washoe County Commissioner Alexis Hill, a Democrat and vocal critic of the tax credits, stated that the outcome “is a victory that belongs to everyday Nevadans. The students who spoke out, groups like AFSCME, teachers, and community members made their voices heard, and we won. I am proud to have been a part of this coalition. This shows what we can do when we work together, that there is still hope in this dark political time we find ourselves in if we stand up and stand together.” A request for comment from the gubernatorial campaign of Nevada Attorney General Aaron Ford, who originated the film tax credit program in 2013, did not receive an immediate response.

For several days, proponents of the proposal engaged in discussions with senators to secure their support, but these efforts ultimately did not succeed. Sources close to the negotiations indicated that three lawmakers—Sens. Edgar Flores (D-Las Vegas), Melanie Scheible (D-Las Vegas), and Angie Taylor (D-Reno)—ultimately voted against the measure. Senator Taylor described the decision as “grueling,” acknowledging the need for economic development and job creation but stating, “I just couldn’t get comfortable with the numbers.”

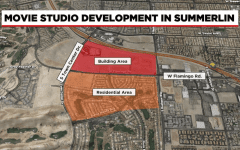

The bill underwent several modifications throughout the legislative process, which began during the regular legislative session in February. These changes aimed to address concerns regarding its economic viability and its potential benefits beyond the film industry. The final version mandated increased investment from film production companies, requiring $900 million in construction by the end of 2030 and $1.8 billion in capital investment by the end of 2039. Failure to meet these targets would subject the planned film studio project in Summerlin to a lien.

Additionally, the bill included provisions for a special tax district in Summerlin, projected to allocate approximately $11 million annually to pre-kindergarten programs in the Clark County School District, serving about 1,290 of 27,000 eligible children. An amendment introduced last week also proposed directing some room tax revenues from the Summerlin district towards health benefits for retired state workers.

Despite these additions, significant opposition persisted from progressive organizations and the American Federation of State, County and Municipal Employees Local 4041, a prominent union for state employees. Opponents highlighted legislative fiscal staff estimates suggesting the state budget would face deficits of around $100 million in fiscal year 2030 and $260 million in fiscal year 2031 if the tax credits were issued—deficits that would necessitate revenue increases or service reductions.

A state-commissioned analysis of an earlier version of the bill projected substantial economic activity but indicated that tax revenues recouped by governmental entities would not offset the state’s investment. While proponents conceded the tax credits themselves would not generate a positive return on investment, they maintained the program would foster job creation and increase residents’ incomes. Their internal estimates suggested the creation of 21,000 construction jobs during the development phase and an additional 17,000 jobs upon project completion. Construction trade unions were key supporters of the bill.

The bill also incorporated language allowing the state to suspend tax credit redemptions during economic downturns, defined as a year with at least a 10 percent reduction in anticipated revenues. Legislative staff noted that such a drastic revenue drop has occurred only once historically. Critics expressed concerns about tax credit redemptions during challenging economic periods. Furthermore, as the credits are transferable and film companies rarely incur the specific taxes that can be credited, studios typically sell these credits at a discount to other entities, primarily gaming and insurance companies, in exchange for cash.

Opponents also raised objections to an amendment that diluted workforce diversity requirements. The amendment removed provisions that would have reduced tax credits if production companies failed to adequately train or provide opportunities for underrepresented groups, or ensure diversity across various levels of film production, including directors and editors. The final version instead set a goal for 30 percent representation of underrepresented groups. Non-compliance could result in withheld tax credits, though sanctions might be reduced if a “good faith effort” to meet diversity standards was demonstrated. The NAACP Las Vegas branch has filed a records request concerning gubernatorial office correspondence related to this change.

Original Source: The Nevada Independent

Copyright 2025 702 Times, NV Globe. All rights reserved.

- CCSD Board Hears Public Input on ICE Protests and School Start Times - January 23, 2026

- Nevada Democrats Vote With the Radical Left to Defund ICE and Jeopardize Public Safety - January 23, 2026

- Gambling Loss Deduction Rollback Blocked as House Advances Funding Bill - January 23, 2026