(Image: Shutterstock)

Nevadans’ Pension Funds Go ‘Woke’

Report finds Investment managers have been leveraging Nevadans’ pension funds to push a radical agenda

By Megan Barth, January 26, 2024 2:29 pm

In an eye-opening report (see below) from conservative watchdog group American Accountability Foundation (AAF), asset managers have been leveraging Nevadans’ pension funds to push for radical, social justice and political initiatives since 2022.

“Racial equity audits,” “climate emissions caps” and the defunding of conservative candidates and organizations are part of an Environmental, Social and Governance (ESG) movement directly impacting the $30 billion stock portfolio of the Public Employees’ Retirement System of Nevada (NVPERS).

According to NVPERS website, “NVPERS plays an important role in the long-term economic security of the state’s public employees, which includes teachers, police officers, firefighters, city, county, and State of Nevada employees, among others.”

The “ESG Movement,” as explained by AAF, “is comprised of a network of left-wing groups that have allied with seemingly mainstream Wall Street investment firms.”

The ESG Movement

AAF found over 200 instances of asset managers “weaponizing money” by voting in favor of shareholder proposals on “racial equity audits, gender pay gap reports, efforts to defund conservative groups and trade associations, and radical climate policy.”

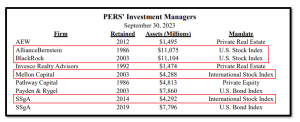

The asset managers responsible for the approval of shareholder resolutions–which directly impact the long-term economic security of Nevada’s public employees–include BlackRock, AllianceBernstein, Mellon Capital and State Street Global Advisors (SSGA).

The report notes:

This unlikely alliance of progressive activist groups and mainstream Wall Street firms has culminated in a multi-year effort to force corporations across America to adopt woke policies. Whether it is DEI initiatives, climate alarmism, or efforts to defund conservative and pro-business organizations, the ESG Movement has been at the forefront of pushing these changes in recent years.

The primary tool used by ESG Movement to advance their left-wing agenda in corporate America is the shareholder resolution. Each year at the annual shareholder meetings of public companies, shareholders can put forward resolutions to force action by corporate boards and management. While shareholder resolutions have typically been used to further good corporate governance practices and to maximize returns for shareholders, the ESG Movement has co-opted the shareholder resolution process to force companies to implement DEI, anti-oil and gas climate policy, and other radical social policy. (emphasis added)

The ESG Extortionists

According to public documents obtained by the AAF, in June of 2023, AllianceBernstein voted NVPERS’ shares in Comcast Corporation in support of a resolution to “oversee and report on a racial equity audit.”

The shareholder resolution was introduced by the SEIU Master Trust. The resolution urged the board of directors to “oversee an independent racial equity audit analyzing Comcast’s “adverse impacts on nonwhite stakeholders, decried ‘systemic racism,’ admonished Comcast for sponsoring the Philadelphia Police Foundation’s annual gala, and criticized the company for donating to candidates that support voter ID requirements and objected to the results of the 2020 election.”

Another resolution, introduced by United for Respect, called for a “third-party, independent racial equity audit analyzing Walmart’s adverse impacts on Black, Indigenous, and People of Color (BIPOC) communities” and said that Walmart “must do more to address significant adverse impacts of its policies and practices on those communities.”

“A racial equity audit would help Walmart identify, prioritize, remedy and avoid adverse impacts on nonwhite stakeholders and communities of color,” the shareholder proposal states. “We urge Walmart to assess its behavior through a racial equity lens in order to obtain a complete picture of how it contributes to, and could help dismantle, social and economic inequality.”

In May 2023, Alliance Bernstein voted NVPERS’ shares in Walmart in favor of a resolution calling for the commissioning of a third party racial equity audit.

The ESG Victims

As per a report from the Daily Caller News Foundation (DCNF):

AllianceBernstein and BlackRock both used NVPERS’ funds to back the Comptroller of the State of New York’s proposal for a report on political donations and spending at Caesars Entertainment, according to the [AAF] report.”

“Without knowing the recipients of our company’s political dollars we cannot sufficiently assess whether our company’s election-related spending aligns or conflicts with its policies on climate change and sustainability, or other areas of concern,” the proposal states. (emphasis added)

AAF contends that these reports on political and lobbying expenditures are used for the purpose of bullying companies into ceasing contributions to conservative candidates and organizations, as well as to trade associations and other pro-business groups. The intent of these resolutions is “to force companies to name trade associations, think tanks, other nonprofits, political committees, and candidates they support, so the woke mob can later shame companies for supporting them.”

BlackRock, State Street, & Vanguard manage over $20 trillion of our money, yet use that $$ to vote for “racial equity audits” & “emissions caps” that don’t maximize shareholder value. They’re retreating from the term “ESG” now that it’s become toxic, but they’re just using…

— Vivek Ramaswamy (@VivekGRamaswamy) January 24, 2024

In a statement to DCNF, AAF president Tom Jones blasted ESG investing as an “irresponsible misuse of public funds” and issued a warning to Nevada taxpayers and pensioners:

“This is a gross and irresponsible misuse of public funds and an outrageous attempt to get around our constitutional system and force policies on Americans they never voted for,” AAF president Tom Jones told the DCNF. “Every state pension fund must take a hard look at who is running their investments, and make sure it is being invested solely with the aim of getting taxpayers and pensioners the best returns.”

Ultimately, this social justice shakedown of publicly-traded companies has not provided shareholders economic security. In fact, the third quarter of 2023 records massive losses in ESG funds.

According to the DCNF:

ESG funds prioritizing environmental and social investments lost $2.7 billion in the third quarter of 2023 as demand among investors plummeted, according to Morningstar. Critics say ESG initiatives are not in the best fiduciary interest of shareholders.

NVPERS denied that the pension funds are used for furthering any social or political agendas in a statement to the DCNF.

“Nevada PERS does not utilize the System’s assets to advance any social or political agendas,” NVPERS Chief Investment Officer Steve Edmundson told the DCNF. Edmundson pointed the DCNF to NVPERS investment policies, which asset managers are also required to follow, that unequivocally prohibit political and social influence.

“Nevada PERS only invests assets in the best economic interest of our members and beneficiaries,” he added. “We do not incorporate secondary social or political considerations in our investment process.”

Yet, the public documents acquired by AAF prove that asset managers of NVPERS violated NVPERS policies by using public funds to engage in political and social agendas.

The Globe has reached out to Nevada Treasurer Zach Conine for comment. We will update the article with his comments when and if received.

.NVPERS-Woke-Investment-Managers

- Illegal Alien Identified As Wrong-Way Driver in Fatal Crash That Killed LVMPD Officer - December 23, 2024

- Senator Rosen Joins Letter Raising Concerns About Pete Hegseth’s Nomination - December 20, 2024

- NV SOS Launches Four Investigations Into 2024 Election Violations - December 20, 2024

One thought on “Nevadans’ Pension Funds Go ‘Woke’”