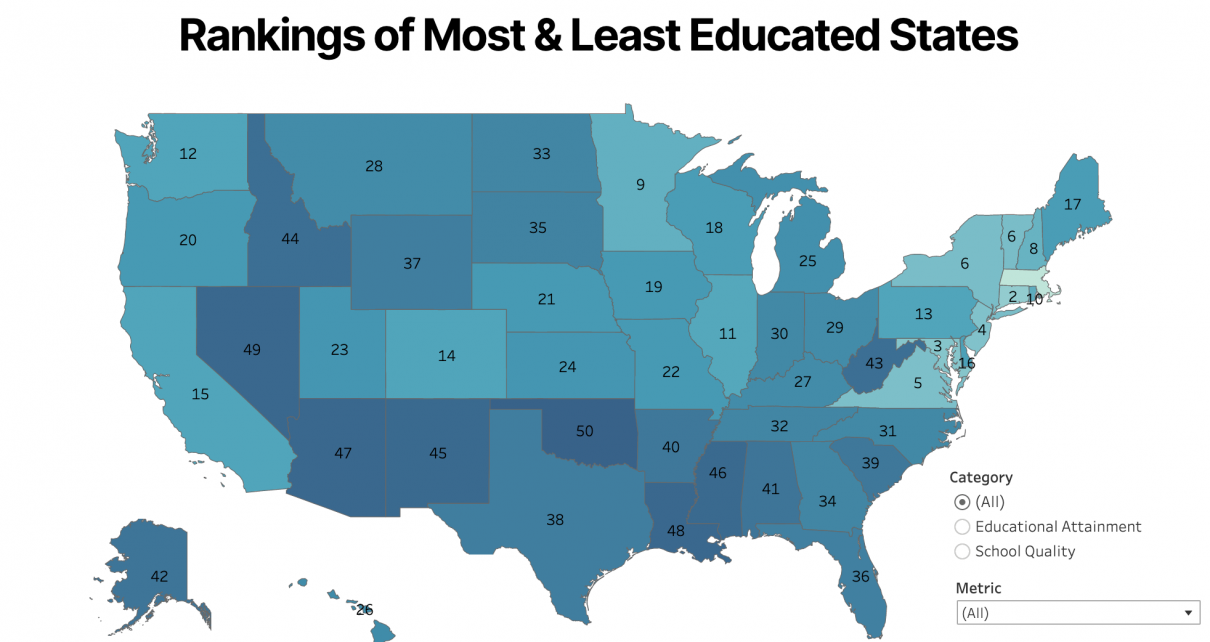

Nevada ranks 49th in least educated state. (Photo: Scholaroo.com)

Nevada Ranks 49th in Education

Oklahoma is ranked 50th

By Megan Barth, February 18, 2022 3:00 pm

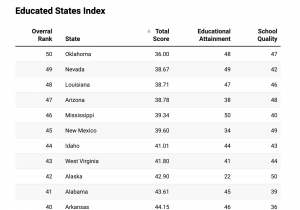

According to a recent analysis published by Scholaroo, Nevada ranks 49th in education, barely edging out last-place Oklahoma. The metrics measured educational attainment and school quality. Nevada also ranked 46th in school systems which measured student access, school quality and student safety.

The analysis concludes: Nevada ranks 49th in educational attainment, 42nd in school quality, 46th in best school systems in America, 47th in numeracy rate and literacy rate, 49th in drop out rate, 48th in master degrees, and last in the share of doctorate degrees in the nation.

As Governor Sisolak prepares to deliver the State of the State next week, he tweets that he has made education a priority in his administration accompanied by a slick video.

When I was elected, I promised I would make education my priority.

That’s what we did.

My administration:

🧑🏫gave our educators pay increases,

📚directed millions in funding to K-12 schools

🏫 secured funding for 13 news schools & are revitalizing 33 more! pic.twitter.com/pv2uyU6tFJ— Steve Sisolak (@SteveSisolak) February 15, 2022

In November, voters will not only decide his fate for reelection, but they will also vote on raising another billion dollars in taxes to fund public schools which would put Nevada at the top–not in education, but in having the highest baseline sales tax rate in the nation.

As reported by The Globe, the history of raising taxes for education has not produced a rise in educational outcomes as politically predicted.

The largest tax increase in Nevada state history–$1.1 billion to reform K-12 education and signed into law by Republican Governor Sandoval in 2015, apparently wasn’t enough to fund the needs for education. According to reports, those who voted for the bill saw it as a major victory for education. They believed the measure would help bring forth many expanded education programs, including one to help English language learners and another to ensure Nevada students read by third grade.

Likewise, neither were the taxes from legalizing marijuana in 2016 enough. At that time, voters were told that the taxes from the revenues generated from marijuana sales would benefit education. In the first year, the revenue for marijuana sales tax of $69 million surpassed alcohol sales tax revenue.

Two years later, in his first year in office, Democratic Governor Steve Sisolak mandated that 10% of marijuana sales tax revenue to be deposited into the state’s distributive school account (DSA).

In 2020, amid the pandemic and shutdown, Nevada saw a record level of tax revenue from marijuana sales. The state collected nearly $100 million in marijuana tax revenue.

To put these numbers in perspective, in 2018, the largest school district in Nevada, the Clark County School District (CCSD) budget was $2.4 billion. The district ranked 35th in the nation in education.

In 2019, with a similar budget, the district ranked 50th. The budget for their 2021 school year is $2.6 billion.

Yet, with this increase in spending, Nevada still ranks among the least educated in the nation at 44th in the nation. In response to these abysmal rankings, CCSD and their union believe that more taxes, more spending, and implementing a new grading system will improve education outcomes. The new grading system is a 50% pass/ fail, and behaviors, such as attendance, participation and late or missing assignments, will not influence a grade.

It is also worth noting that $200 million has been allocated for K-12 education from the state’s share of $2.7 billion in federal American Rescue Plan (ARP). This allocation must be approved by the legislature which convenes in a special session in November or will be heard in regular session in 2023.

Yet, faced with another “budget crisis”, the Clark County Education Association, took to the streets during a pandemic shutdown and surprisingly gathered enough signatures for two ballot initiatives.

These ballot initiatives would raise taxes on gambling revenues and sales taxes: from 6.75 percent to 9.75 percent of all gaming revenue of more than $250,000 in one month in which those proceeds would go to the general fund; sales taxes would increase by 1.5 percent with a portion directly allotted to education, bringing the state’s baseline sales tax rate to 8.35 percent, making Nevada the highest base-line tax rate in the nation. With counties have differing sales tax rates, that change would result in a 9.875 percent sales tax in Clark County, which would also be the highest local tax rate in the nation.

However, in lieu of the tax increase on the state’s mining industry, which was passed by the legislature and signed into law by Governor Sisolak, the union agreed to withdraw these petitions. The Attorney General, Aaron Ford, supported this withdrawal, but Sec. of State Barbara Cegavske did not.

Politicians have taxed mining, marijuana, casinos and tax payers (multiple times over) but has yet to produce any results proving that raising taxes yields better educational outcomes. In fact, according to this recent analysis, the outcomes have gotten progressively worse.

- Illegal Alien Identified As Wrong-Way Driver in Fatal Crash That Killed LVMPD Officer - December 23, 2024

- Senator Rosen Joins Letter Raising Concerns About Pete Hegseth’s Nomination - December 20, 2024

- NV SOS Launches Four Investigations Into 2024 Election Violations - December 20, 2024

I have always had concerns when it came to education. from the time my children were attending Public Schools in Syracuse, NY to now when my grandchildren are facing the same issues with their children. I retired and moved to Nevada and am learning about the disgraceful performance in the Public schools here that I decided to do something about it. i am so concerned for Nevada that I am the Coordinator for the Lions International Lions Quest Program for Nevada. I am rallying interest in this world effort to help children achieve skills that will take them into a successful future. they will learn how to become competent in Self Awareness.Self Management, and be able to learn responsible decision making. i would love to speak to someone about this or you can research the program at lionsquest.org