Medicinal Marijuana plant (Photo: Shutterstock)

Senator Rosen Urges Support For SAFE Banking Act

Bipartisan legislation seeks to put an end to reefer madness

By Kiera Sears, May 4, 2023 12:09 pm

On March 7, 2019, H.R. 1595, the Secure and Fair Enforcement (SAFE) Banking Act, was introduced for the first time into the House of Representatives. It was passed on September 25, and after being read twice into the Senate, it was referred to the Committee on Banking, Housing, and Urban Affairs, where it would remain for the next two years. On March 18, 2021, it was again introduced as H.R. 1996, but would end up meeting the very same fate.

Now, two years later, sponsor Rep. David Joyce (R-OH) has introduced it a third time as H.R. 2891. Currently under review by the Committee on Financial Services, the Committee on Judiciary, and the Committee on Veterans Affairs, the bill has received substantial bipartisan support and is likely to make its way back to the Senate. Cosponsors of the bill include Rep. Blumenauer [D-OR-3], Rep. Davidson [R-OH-8], Rep. Himes [D-CT-4], Rep. Mast [R-FL-21], Rep. Lee [D-CA-12], Rep. Reschenthaler [R-PA-14], Rep. Velazquez [D-NY-7], Rep. Chavez-DeRemer [R-OR-5], and Rep. Correa [D-CA-46].

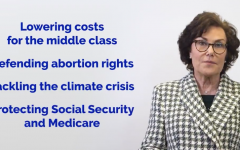

Early Senatorial support comes from our own Senator Jacky Rosen, who recently tweeted, “Legally operating cannabis businesses deserve full access to @SBAgov resources. It’s time to pass the bipartisan SAFE Banking Act to protect NV jobs, support small cannabis businesses, and increase public safety.”

Legally operating cannabis businesses deserve full access to @SBAgov resources.

It's time to pass the bipartisan SAFE Banking Act to protect NV jobs, support small cannabis businesses, and increase public safety.https://t.co/Pe75I9qmWi

— Senator Jacky Rosen (@SenJackyRosen) April 29, 2023

It would indeed be odd for any Nevada representative not to support the bill, as the legalization journey of cannabis within the Silver State has been going strong for over two decades, with State-sanctioned marijuana businesses in operation since 2015.

Legalization first occurred in Nevada in November of 2000, when 65% of its voters approved medial use for patients via home cultivation, though establishments were not authorized until 2013 with the passage of Senate Bill 374. In August 2014, 519 applications were submitted for review to the Division of Public and Behavioral Health, and on November 3, 2014, 372 provisional certificates were granted. Nevada would see its first dispensary open in July 2015, and in November 2016, Nevada voters finally approved complete legalization for adults over the age of 21.

Fast forward to March 2020 when Governor Sisolak declared cannabis establishments “essential businesses” during the pandemic and allowed their operations to continue throughout the lockdown. However, as Federal law continued to categorize cannabis as a Schedule I substance, those same establishments were unable to secure payroll and small-business loans. For nearly a decade, Nevada license holders have been almost entirely shutout from banking, despite its dispensaries alone generating nearly $1 billion in revenue annually.

With its submission of the 2023 SAFE Banking Act, Congress seeks to put an end to the reefer madness. This bill has been reintroduced with the purpose of “creat[ing] protections for financial institutions that provide financial services to State-sanctioned marijuana businesses and services providers for such businesses…” Since the first cannabis establishment opened in California in 1992, there has been little progress in terms of financial services and protection, and both customers and businesses have been forced to deal strictly in cash.

A small glimpse of reprieve came in 2019, when Assembly Bill 466 authorized the Nevada Treasurers Office to move forward with a pilot program that would enable marijuana establishments, consumers, medical patients, and others to engage in financial transactions in a safe and efficient manner. Greater Nevada Credit Union became one of the first participating banks, working with third-party verification systems that would pre-screen each establishment, and monitor each of its sales transactions. However, it wasn’t entirely the same as other business banking. Each establishment was required to install a safe within its location, where cash could be directly deposited, and when the safe was full or ready to be emptied, an armored car would be sent to collect the money; its guards would then deliver the cash as a bank-authorized deposit. Establishments were able to issue checks and set-up payroll, but other financial services remained limited.

After years of advocating for safer mechanisms, industry participants are ready for change. If enrolled as law, this bill would prohibit banking regulators from penalizing or discouraging banks and credit unions from providing depository services to cannabis establishments, and also for providing loans. Proceeds from such businesses would no longer be considered unlawful, and banks could even approve home mortgage loans for those whose income is derived solely from the industry. Marijuana businesses would still be required to provide sufficient records demonstrating the source of their currency, and deposits would be monitored to ensure their reasonableness, in relation to expected revenues.

And lastly, but most certainly not least, Federal banking agencies would no longer be authorized to terminate accounts, unless it was determined that such individual or entity posed a threat to national security, was involved in terrorist financing, or engaged with a government that is tagged as a State Sponsor of Terrorism.

While the passage of this bill would provide relief for individuals and businesses in 38 states (and most certainly more to come), it would fail to change one thing.

As the Federal Government still prohibits the use, sale, and distribution of marijuana, and as bankruptcy lies wholly within the jurisdiction of the Federal Courts, State-sanctioned marijuana establishments are prohibited from filing for bankruptcy and will remain so until such time as Congress or the Judiciary see fit.