Pain at the pump in Nevada. (Photo: Pixel 4 Images/Shutterstock)

Assembly Dems Push For Taxation Without Representation

Clark County Dems sponsor AB359 which voids voter approval for County to increase gas taxes

By Megan Barth, May 8, 2023 3:20 pm

Currently, Clark County Commissioners are authorized to raise gas taxes by a two-thirds majority vote every year until the year 2026. Any additional gas taxes, starting in January 2027, must be approved by a majority vote of the Clark County residents in November 2026. Assembly Bill 359, sponsored by Clark County Assm. Daniele Monroe-Moreno (AD-1), Howard Watts (AD-15) , Claire Thomas (AD-17), and C.H. Miller (AD-7), voids voter approval to approve an increase in gas taxes and allows the County Commissioners sole authority to raise gas taxes.

According to the bill’s language, “this bill authorizes the continued imposition of additional increases in these taxes if the board of county commissioners, on or before December 31, 2026, adopts an ordinance authorizing the effectuation of such annual increases.”

The Southern Nevada Transportation Commission submitted a power point presentation promoting AB359. They estimate that the tax could generate $1.2 billion between FY 2028-2037 with $410M going to the Nevada Department of Transportation, $143M to Clark County, and $607M to RTC.

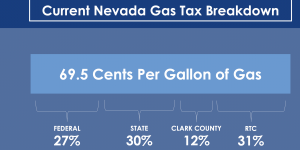

Every gallon of gas in Nevada is subject to 69.5 cents of tax per gallon. The breakdown is as follows:

In a recent report by the Las Vegas Review Journal, tax payers are subsidizing luxury vehicles and mileage for government employees:

Taxpayers are footing the bill for Cadillacs, Audis, Teslas and other luxury vehicles for some of Southern Nevada’s highest-compensated government employees — vehicles the workers keep when they leave…In 2021, Clark County and the Clark County School District each had more than 40 employees with vehicle allowances, costing taxpayers about $400,000 combined…The county also has more than 2,500 fleet vehicles — ranging from specialized work vehicles like tractors and ambulances to a half dozen Tesla Model 3s — for its various departments. Taxpayers paid $147 million for those vehicles. And the county pays out about $100,000 a year in mileage reimbursements split among nearly 500 employees, records show.

This report is included in Chairman of the Nevada GOP Michael McDonald’s opposition statement: “[Clark County] has a spending problem, not a revenue problem. A county this corrupt is desperately in need of a check on their taxation powers – not a facilitation to expand them.”

- Illegal Alien Identified As Wrong-Way Driver in Fatal Crash That Killed LVMPD Officer - December 23, 2024

- Senator Rosen Joins Letter Raising Concerns About Pete Hegseth’s Nomination - December 20, 2024

- NV SOS Launches Four Investigations Into 2024 Election Violations - December 20, 2024