President Joe Biden delivers remarks on lowering prescription drug costs, Wednesday, March 15, 2023, at the University of Nevada in Las Vegas. (Official White House Photo by Adam Schultz)

March Madness: Silver State Inflation Surges Past 21 Percent

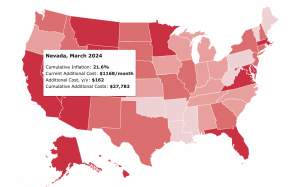

Since President Biden assumed office, Nevadans are paying an extra $27,782 per year for basic household expenses

By Megan Barth, April 10, 2024 10:25 am

Despite the Federal Reserve stating that inflation was “transitory”, the passage of the Inflation Reduction Act, and partisan claims of economic progress, the Bureau of Labor Statistics (BLS) reports that consumer prices rose 3.5 percent in March compared to a year ago. Core inflation, which excludes energy and housing, remains at 3.8 percent. The Feds Fund rate remains at 5.25 percent to 5.5 percent, matching its highest level in 23 years.

Last month, the Fed indicated that it intends to make three interest rate cuts this year, but remains cautious.

The BLS also reports that more than half of the monthly increase in prices was driven by a spike in housing and energy costs and has prolonged economic recovery. Additionally, the Fed admits that the “better than expected” jobs report last month was due to an increase in part-time employment.

Since President Joe Biden assumed office, consumer prices have risen over 19 percent.

The Chairman of the Joint Economic Committee (JEC) Senator Martin Heinrich (D-NM) released the following statement, indicating that the government needs to subsidize (spend more money) on child care to offset the “hidden tax” of inflation:

While inflation remained higher in March, yearly inflation is still down nearly two-thirds since its peak. At the same time, wages and salaries continue to grow faster than prices, outpacing price growth since January 2021 by nearly $4,800 based on recent data.

There’s still work to be done to lower everyday costs. One of the biggest expenses for families is child care, and that’s why I’m holding a hearing this afternoon to examine ways we can invest in early childhood education. When families have access to affordable and reliable early childhood education, it makes it easier for caregivers to work, afford necessities like groceries and rent, and save for retirement – not to mention the benefits it has for children’s academic outcomes and future job prospects. States like New Mexico are leading the way in providing accessible child care and pre-K to every family, and I’m looking forward to discussing how we can address funding shortfalls on the federal level.

The JEC reports that Nevada’s inflation rate rose to a whopping 21.6 percent, an increase of one percent from last month. Relative to January 2021 prices, Nevadans are paying an additional $1,168 per month, or $27,782 per year, for basic household expenses. Back in November, 2023, The Globe reported that Nevadans are spending over $13,296 per household due to “Bidenomics.” In May 2022, The Globe reported that Nevadan households were hit the hardest by inflation. At that time, Nevadans were paying an additional $8,231 annually for basic household expenses.

Although rising wages has become a progressive talking point, the rise in wages is consumed by rising prices for everyday necessities like energy, shelter, and food.

Additionally, wages have actually fallen or remained stagnant since President Biden took office. To compare wages over time and in relation to inflation, Statista reports, “In 2022, the usual median hourly rate of a worker’s wage in the United States was 18.12 U.S. dollars, a decrease from the previous year. Dollar value is based on 2022 U.S. dollars. In 1979, the median hourly earnings in the U.S. was 16.75 dollars.”

- Illegal Alien Identified As Wrong-Way Driver in Fatal Crash That Killed LVMPD Officer - December 23, 2024

- Senator Rosen Joins Letter Raising Concerns About Pete Hegseth’s Nomination - December 20, 2024

- NV SOS Launches Four Investigations Into 2024 Election Violations - December 20, 2024