Briana Johnson, Clark County Assessor, elected in November of 2018 (Photo: ClarkCountyNV.gov)

The Clark County Property Tax Scam

County Assessor assumes every homeowner is a renter to assess property tax increases

By Megan Barth, June 29, 2022 12:00 pm

The Clark County Assessors office considers itself “The most technologically advanced assessors office in the country” and claims to perform “accurate and equitable assessment functions to serve the public.”

If the above statement weren’t such a joke, this wouldn’t be a story. But this is a big, developing story and it has to do with the pilfering and deceptive practices of the assessors office who has been automatically assuming that all home owners are renters of their primary residence. This assumption allows the county to assess an eight percent tax, instead of the legal limit of three percent, on all home owners UNLESS the homeowner fills out a small, nondescript post card claiming that their address is their primary residence.

Is a postcard the “most technologically advanced, user friendly” method to alert homeowners that their taxes will go up five percent in a given year? Obviously not. But why send a first class letter from the assessors office, which the office does every year to collect property taxes, when a post card can get lost in the mail, shoved into junk retail flyers, or overlooked by the homeowner, thereby allowing the county to assume and charge eight percent to fatten the county coffers.

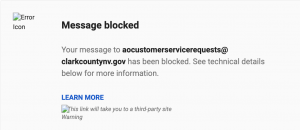

This egregious practice was first announced on a handful of Clark County community Facebook pages this week and started to go viral. So viral that I was contacted by a concerned citizen. So viral that the assessors website crashed and it took a home owner two hours to find her parcel number and tax statement. So viral, that according to their website, their phone systems are overrun for the “tax cap card” since the card, which is now provided as a PDF document, has to be returned to the county, via email or in person, by tomorrow, June 30th. So viral that the County just announced at 11:30 am that the Clark County assessor will be available at 12:30 today (via a Microsoft Teams Meeting) to take questions from the media regarding this property tax cap deadline. The Globe will be on this call.

It is important to note that state law protects homeowners from steep property tax hikes by limiting annual property tax increases to a maximum of 3% for primary residences. If a person owns a property that isn’t a primary residence – a rental property, vacant land or a second home, for example – the property tax on that property can increase by up to 8% over the previous year–thanks to legislation passed by the Democratic majority. Nowhere in the legislation grants the authority to the assessor to automatically assume and assign tenancy.

After doing a bit of digging and making dozens of phone calls, I found that many Clark County homeowners who have lived in their primary residence for eight or more years were being charged eight percent. Some of the homeowners filled out and returned the post card yet were still assessed eight percent. Many of these homeowners were not aware of, nor did receive, a post card. I am one of those homeowners.

As a new homeowner, my house sat vacant for seven months prior to my purchase. I closed on my house in June 2021. Therefore, I never received a post card and in 2021 and 2022, I was charged eight percent. I took part in the booming real estate market in Nevada, which saw sales and prices of single family homes rise to historic numbers.

According to Fox 5 news April 2022 report:

Statistics for March 2022 show that the median price of single-family homes sold in the valley was $460,000, breaking February’s record. That price is up 26.7% year-over-year, with $363,000 as the total for March 2021. Condos and townhomes in March sold for $270,000, a 39.2% increase from $194,000 last year.

According to Las Vegas Realtors President Brandon Roberts, home prices have almost quadrupled since the post-recession bottom when homes were valued at $118,000 in 2012.

The report says 2021 was a record-setting year for local homes sales in Southern Nevada, with 50,010 properties sold.

“That was the first time the association reported more than 50,000 local properties changing hands in a year and topped the previous record set in 2011 by nearly 2,000 sales,” according to the data.

During March 2022, 30% of properties were purchased with cash.

TOTAL REAL ESTATE VALUE UP BY 8% and 21.2%: $1.8 billion (HOUSES), $263 million (CONDOS/TOWNHOMES)(tracked through the Multiple Listing Service (MLS)

SELLING FASTER: In March, 89.9% of all existing local homes and 94.5% of all existing local condos and townhomes sold within 60 days. That compares to one year ago, when 84.0% of all existing local homes and 80.9% of all existing local condos and townhomes sold within 60 days.

A booming real estate market also yields a booming tax collection racket, a racket that automatically assumes that all existing and new homeowners are renters and can be assessed eight percent instead of three percent.

The Globe contacted many elected officials, candidates, and homeowners to weigh in on this story.

Danielle Gallant, GOP nominee for Assembly District 23:

“Four years ago, legislation was implemented requiring homeowners to report the difference between their primary residence and any investment properties they owned. While the intent of this legislation was to increase revenue for the state, the process itself was flawed.

Each year, homeowners are mailed a postcard. If it is not received, filled out, and returned, that address is classified as an investment which results in a property tax increase from 3% to 8%.

Despite receiving and sending our postcard back last year, our own family’s home was somehow declared an investment property and our taxes went up. This illustrates just how flawed a multi-step government process like this can become.

First, we have to rely on the post office to deliver and return the mail to the correct addresses. Then we need the Recorder’s mail room to receive the mail, get it to the right department, and for it to be accurately recorded. Then finally, we need the hardware and software to operate correctly without any glitches.

While I don’t know specifically which one of these steps nearly tripled my taxes, it is painfully apparent that the process itself is flawed and that we need a better solution.

I am happy to work with or speak to any constituent regarding this issue or any issue. They are free to email me at danielle@danielle4nv.com or call 702-291-8598.”

Clark County home owner and business owner:

“They got me with this scam last year. Luckily my mortgage lender tipped me off that the taxes were higher than others he was refinancing. I went down there and had them reset the cap but it was infuriating that the default action, when they are in doubt, is to automatically assign the higher rate. It should be the reverse. Someone made the decision to do it like this and that person or committee needs to be held accountable.”

Drew Johnson, GOP nominee for Clark County Commissioner District F:

“By assuming huge numbers of homeowners don’t live in the homes they own, county officials will unfairly steal tens of millions of dollars from Clark County residents this year. It’s a shady, shameful, unethical attempt by the county government to rip people off.

I encourage everyone to check their property tax account at the Clark County Treasurer’s website and make sure the property tax on their primary residence is set at a 3% tax increase cap.

Our home was set at an 8% increase, rather than a 3% cap, even though it’s our primary residence. If I hadn’t checked and emailed in a form to contest it, my wife and I would’ve lost hundreds of dollars – and I would’ve never found out. Like most people, my property tax payment is rolled into my mortgage escrow, so I don’t pay close attention to the exact amount most years. The county would’ve stolen our money and I would’ve never known.”

Mitchell T Tracy, Republican Nominee for Clark County Treasurer: “It’s terrible what the Clark County Assessors office did to Clark County property owners. I feel this was done by design by all the Clark County Elected Officials in positions dealing with property taxes even the Treasurer. Being great Socialists no on has stepped up to do what is right. Socialists blame everyone but themselves.”

This is a developing story…

- Illegal Alien Identified As Wrong-Way Driver in Fatal Crash That Killed LVMPD Officer - December 23, 2024

- Senator Rosen Joins Letter Raising Concerns About Pete Hegseth’s Nomination - December 20, 2024

- NV SOS Launches Four Investigations Into 2024 Election Violations - December 20, 2024

I actually sent the postcard back and when I checked my property tax assessment sure enough it was 8%. Don’t know how many years they have charged the 8%. This home was always our primary resident, never overlapped buying and residing in two homes. Wish they would refund the overcharge they got away with doing.

I believe you can file a complaint/inquiry online in the form of an abatement. It would be worth a try.

The Assessor site needs updating. I don’t see where we can change our address on the site. Our information shows a previous address in another state when we purchased this home but the N Las Vegas home is our primary and only home, purchased in 2021. It also shows a rate of 3.3544 – not 3.0, if that should be the current capped rate.

Where are the consumer protection agencies when the scammers are in government? There needs to be consequences for this level incompetence.

This needs to be the top story on the local news and LVRJ.

Interesting thing about Tax Scams – small taxes add up to big money. Organized crime was scamming gas taxes. 100,000 gallons of gasoline -a month- skimmed of 30 cents a gallon tax, equals big money

Ironically we purchased out property in the late 80’s. We built a home in 1994. This has been our home for 28 years. We raised 6 children in this home. This is outrageous on it’s face. This is tax fraud by the Clark County Commision, and Clark County Acessor.

There will by lawsuits.

WOW, I got totally attacked on my community FB page for even referencing this article, Heritage at Cadence.

This isn’t an accident. For it to happen the Recorder’s office and assessor’s office had to conspire together. I suspect at the instruction of Justin Jones and other county commissioners. Vote them all out.

What bothers me is these county officials are CRIMINALS! If Joe Citizen owned a business and did the same he would be charged by the state and maybe even the feds! So someone please explain why these county officials are “exempt” and or “ABOVE THE LAW”…It’s just not right!

Property tax itself is increasing yearly at an alarming rate for me. The last 4 years, just the property value has gone from 33,000 to 40,000 to 49,000 and now 59,000. This has been my only home here since 1978. The scam goes deeper than the precious 3% cap.

What is the law to regulate this??

Who do I call for help?