Steven Horsford with President Biden. (Photo: Twitter)

On Tax Day, Rep. Horsford Says System is ‘Rigged’ for Wealthy

Congressman says rich don’t pay ‘fair share’ but that’s not what the data say

By Ken Kurson, April 18, 2022 11:57 am

It’s that time of year. Tax season brings predictable pain and anxiety to millions of Americans. But just as predictably, mid-April brings Democratic elected officials out to say that the wealthy “don’t pay their fair share.”

Press play to hear a narrated version of this story, presented by AudioHopper.

On a video featured by the Nevada progressive advocacy group Battle Born Progress—a “non-partisan” outfit whose front page declares “we fight the right in Nevada”—Congressman Steven Horsford appeared as a guest for their Tax Day event. Rep. Horsford is quoted as saying, “The current federal tax code is rigged for the wealthy against the worker.” He added, “It’s only fair that the wealthy pay their fair share.”

That sounds so axiomatic and reasonable that it’s like suggesting “water is wet” or “always split eights.” But do the rich really pay too little in taxes? Is the system really “rigged” against poorer Americans?

Let’s take a look at this without emotions or politics.

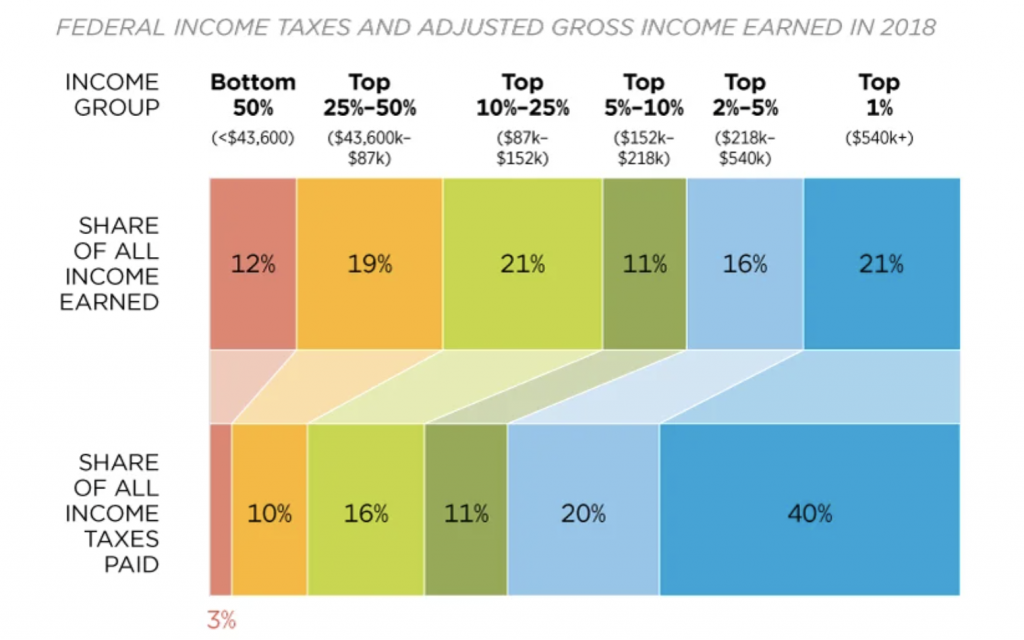

In 2018, the last year for which complete data is available, the top 1% of income earners—earning $540,000 put Americans in that group — earned 21% of all US income. That’s a lot. 1% of the people taking more than 1/5 of the pie. But they also paid 40% of all federal income taxes.

The next tranche, 2% through 5% earned 16% of all income. They paid 20% of all taxes. (It required an income of $218,000 to $540,000 to be in the top 2 to 5%.) Rounding off the top 10, the top 5 to 10% (meaning $152,000 to $218,000 in income) made 11% and paid 11%. That means the top 10% earned 48% of America’s income and paid 71% of all the taxes.

Now let’s look at the rest of America. People in the top 25 to 10% of America—meaning those who earned $87,000-152,000 of all income—made 21% of all income. But they only had to pay 16%. Those in the 50 through 75 percentile $43,600 through $87,000—earned 19% of America’s income but cover only 10% of its expenses. And the entire bottom half of the US, meaning earned less than $43,600, which is the median for 2018, were only saddled with 3% of all income taxes paid. That’s half of America paying a total of 3%.

Again if you’re in the bottom 50%, it means you don’t have a ton of money. Therefore you cannot pay for America’s expenses and ought not be asked. But does that sound “rigged”? They earned 12% of America‘s income and paid 3% of America’s expenses. That actually sounds like a pretty progressive tax policy that’s doing what its advocates say it should be doing.

Same on the other end. No one should be crying for the top 1%. Anyone earning over $540,000 a year is unworthy of economic tears. But are they worthy of contempt? Does 1% of the people paying 40% of the country’s expenses sound as though they’ve schemed to avoid taxes? If they have rigged the game, they must be pretty bad at it.

While President Trump’s 2017 tax cuts have been a popular target as some sort of sop to the rich, in fact they reduced the tax bills for the lowest income Americans by about 10%, while cutting taxes for the top 1% by only .04%. Following those tax cuts in 2017, the 2018 data show that the top 10% pay a larger share of income taxes, not smaller.

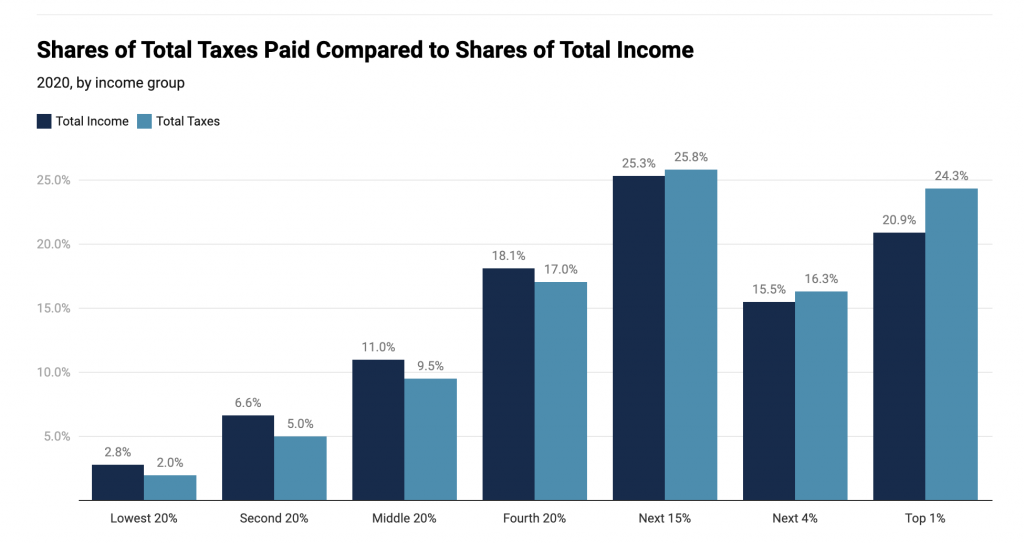

In case anyone reading this is eager to leap to the conclusion that this data, collated directly from the IRS, has been manipulated by the Heritage Foundation, note that the liberal Institute on Taxation and Economic Policy arrived at essentially the same conclusion. It studied the slightly different question of ALL taxes rather than federal income taxes, and broke it down along different lines. But they concluded essentially the same thing: The rich pay a lot and the poor don’t. As it should be.

According to ITEP, The top 1% collected 20.9% of the income and paid 24.3% of the taxes. The bottom 60% got 20.4% of the income and paid 16.5% of the taxes. That’s 60% of the public paying far less than the richest 1%. Again, if this is what it looks like when the rich rig the system, they must be pretty bad at rigging the system.

- Scoop: Green Party Submits 20K Signatures for Nevada Ballot - May 20, 2024

- Capt. Sam Brown’s Family Owns the Cincinnati Bengals - May 4, 2022

- A Deeper Dive Into Tisha Black’s Finance Report - April 22, 2022